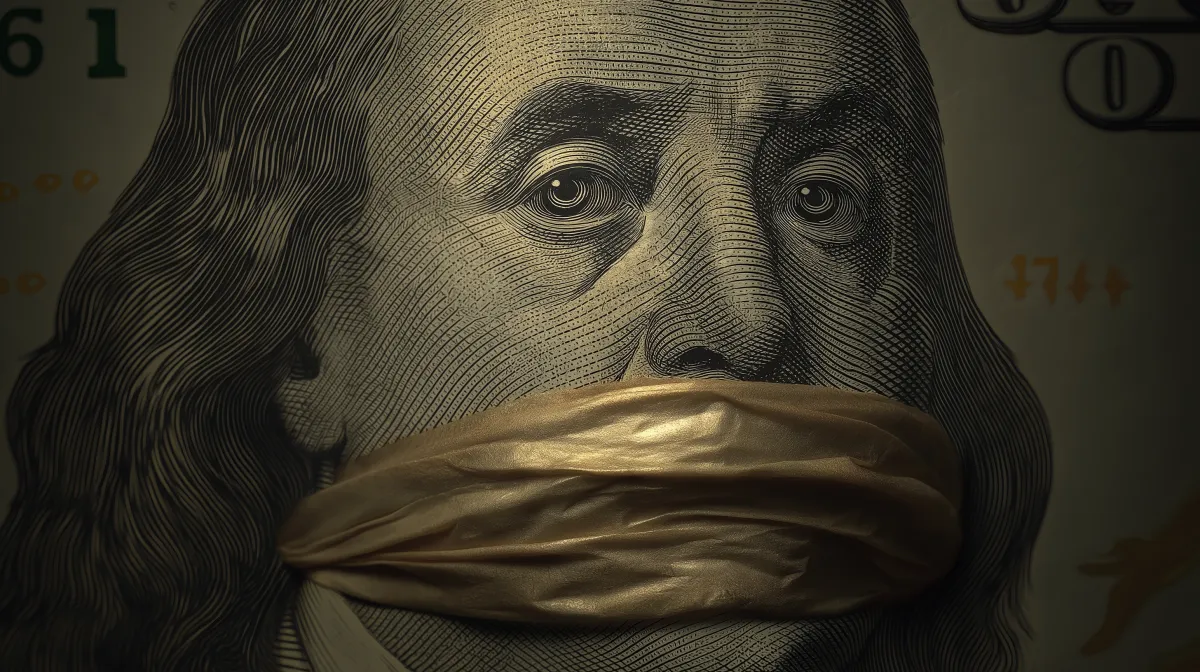

Bankers Blacklist

Removal unlocked!

Bankers Blacklist Removal™

(Exclusive Access)

Have been denied opening a bank account?

You have been blacklisted!!

Limited-Time Offer – Act Now!

Total Value: $97

Today For Only: $37

Were you ever denied opening a checking account with major banks (Chase, BofA, Wells Fargo, Citibank, etc)? Have you ever overdraft on your checking account and now you are struggling with opening a basic bank account? We’ll show you how to get off the blacklist, rebuild trust with top banks, and open new accounts with confidence. There is a strategy to get off the blacklist! Order the Bankers Blacklist Removal™ short mini-course. The easiest and quickest way to regain access to banks ASAP.

Offer Only Available Here.

Put In Your Information and

Let’s Get Started!

Contact Details: Step 1 of 2

🔒 BONUS: Bankers Blacklist Removal™ Guide

Why You Keep Getting Denied—Even If Your Credit Score Improves

😕

Most people don’t know this, but banks keep internal records that go far beyond your credit score.

If you’ve ever:

Had an account closed due to overdrafts

Been flagged for suspicious activity

Owed fees and didn’t pay

Bounced too many checks

Got caught in identity fraud or a freeze

🚫

You may have been quietly placed on the Bankers Blacklist.

This is why you can:

❌ Get denied even with a "decent" credit score

❌ Be told “we can’t open your account at this time” with no explanation

❌ Be rejected by every big-name bank no matter how much progress you’ve made

🏦

What the Bankers Blacklist Removal™ Guide Does:

Reveals which databases banks use to flag consumers (ChexSystems, Early Warning Services, etc.)

Provides step-by-step removal instructions so you can clean your name from internal bank reports

Shows you how to legally reset your relationship with Tier 1 banks like Chase, Wells Fargo, Bank of America, and more

Includes template letters and scripts to remove your name, dispute false flags, and request reentry

✨ Real Benefits You’ll See:

Finally get approved for checking accounts, debit cards, and credit cards

Access to credit-building tools and small personal loans

Rebuild your financial reputation at the institutional level—not just the credit level

🔓 Combine This with Credit Freedom FastTrack™ System and You’re Fully Unlocked

Fix your credit report.

Clear your name with banks.

Get approved again.

Frequently Asked Questions

Got questions? We’ve got answers!

What is the Bankers Blacklist?

It’s a digital guide to reveal hidden record banks use to track negative behavior like unpaid fees, fraud alerts, or overdrafts. Even with a decent credit score, you can be denied a new account if you’re blacklisted.

How do I know if I'm on it?

If you’ve ever been denied a checking account or been told you’re not eligible to open one “at this time,” chances are—you’re on a bank reporting system like ChexSystems or Early Warning Services.

What does this include?

You get:

- A list of the main bank reporting agencies

- Exact steps to request your file

- Dispute templates to remove false or outdated information

- A process to reestablish trust with major banks

Is is this legal to do?

Yes. You’re entitled to access and dispute your records under federal law, just like with credit reports.

Will this help me get a new bank account?

Yes—this process has helped users reopen accounts, get access to online banking, and even unlock credit card approvals that were blocked due to internal flags.

Why haven't I heard of this before?

Most banks don’t talk about it—and most “credit experts” don’t teach it. That’s why it’s your competitive edge when rebuilding your financial standing.